Drug Pricing Expert Witness

A drug pricing expert witness understands pricing trends and drug classification systems and how these impact the overall cost of health care. Our team has over 35 years of executive experience in drug pricing expertise pharmaceutical supply chain management and pharmaceutical pricing. To understand drug pricing in the product supply chain and bundling and purchasing conventions for pharmaceutical products and other medical supplies, it is important to understand drug and pharmaceutical classification systems. Drug pricing experts should know that payor drug pricing models are often managed by pharmacy benefits management (PBM)s. Most importantly, in drug pricing expert testimony in litigation where collateral source rules apply, our team specializes in proving the Usual Customary and Reasonable (UCR) rates for drug charges. Note: Featured image credit: Academy of Managed Care Pharmacy

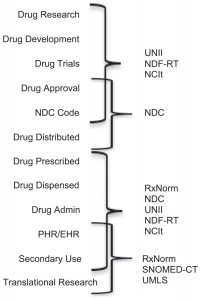

Standardized biomedical information provides benefits in conducting research. However, the practical use of this information often requires mapping across terminological systems—a complex and time-consuming process. According to the National Library of Medicine papers, there are at least 12 standards nd drug databases of import. Nonetheless, a practical approach must be taken when providing opinions regarding the Usual Customary and Reasonable Charge data for drug pricing. Here is a very brief look at three major Classification Systems a drug pricing expert should know: NDC, GPI, and RxNorm. There are ancillary systems such as GDC and AHFS that an expert witness should be able to discuss. For health care and drug claim reimbursement, HCPCS codes are also important.

National Drug Code (NDC)

The Drug Listing Act of 1972 requires registered drug establishments to provide the Food and Drug Administration (FDA) with a current list of all drugs manufactured, prepared, propagated, compounded, or processed by it for commercial distribution. (See Section 510 of the Federal Food, Drug, and Cosmetic Act (21 U.S.C. § 360)).

To elaborate, drug products are identified and reported using a unique, three-segment number, called the National Drug Code (NDC), which serves as a universal product identifier. According to the FDA, “Section 510(p) of the FD&C Act (21 USC 360(p)) now requires registration and listing information for human drugs to be submitted electronically.” NDC can be displayed in 10 digits but proper billing requires that 11 digits of the NDC be used. Drug pricing expert analysis is better served with full 11 digit NDC information.

NDC includes package size and manufacturer in its taxonomy.

For example: 3 code segment (XXXXX – XXXX – XX)

• Labeler code (manufacturer)

• Product code (strength, dosage form, formulation)

• Package code (package size/type)

Generic Product Identifier (GPI) from Medispan

To better understand drug pricing, one should also understand GPI. The Medi-Span Wolters Kluwer GPI (Generic Product Identifier) denotes pharmaceutically equivalent drug products. Products having the same 14-character GPI are identical with respect to the active ingredient(s), dosage form, route, and strength or concentration. The GPI does not consider the presence of inactive ingredients. Importantly, health plans (payors) and pharmacy benefit management systems (PBMs) use GPI for formularies. All of these factors should be comprehended in proper drug pricing expert analysis. For example, category 57 of the GPI, Central Nervous System Agents has 98 entries from ALPRAZolam to Xanax XR.

GPI Classification System Strengths:

1. Each number has a defined meaning (not random) and is a

sequential flowing system. If you see 17 as the first couplet, for example, you know it is a vaccine and

every other number after it describes the vaccine even further

3. Simple, logical, and easy to use

4. Specific: detail taxonomy drug code system with many-tiered levels

GPI Classification System Weaknesses:

1. Does not subdivide into package size or manufacturer, such as NDC codes

Generic Code Number (GDC) from First Databank (FDB)

5-digit code to represent a clinical formulation

Specific to:

Ingredient, Strength, Form, and Route

Same across manufacturers and/or package size

Can be used to group pharmaceutically equivalent products together

One drug can have multiple GCNs depending on the product’s available strength, forms, and route of administration.

GDC Strengths

Same across all manufacturers, package size, and brand/generic products.

The specific set of numbers per product

Does not require consistent updating

Limitations

Absence of logical flow in the code (no significance in each number)

Does not include indication/class of drug

Only identifies Ingredient, Strength, Form, and Route

Harder to identify an ingredient using just the code alone

American Hospital Formulary Service (AHFS)

From American Society of Health-System Pharmacists (ASHP)

From American Society of Health-System Pharmacists (ASHP) and is a 4 tier hierarchy classification: Each tier describes a specific subset of drugs:

• 31 classifications in 1st tier

• 189 classifications in 2nd tier

• 269 classifications in 3rd tier

• 105 classifications in 4th tier

Strengths:

• Subdivides into multiple categories

• Simple to see the logic and flow

Limitations:

• Variety of combinations are possible for certain medications

• Non-specific code – Especially for medications with multiple indications

• Requires constant maintenance and updates regarding drug assignments and classification changes

• List of annual changes and updates can be found on the ASHP website

• Example: • Solvaldi Old AHFS Class: 8 : 18 : 32 (Nucleosides and Nucleotides) • Solvaldi New AHFS Class: 8 : 18 : 40.16 (HCV Polymerase Inhibitors)

RxNorm – the Electronic Health Record Drug Classification Standard

Drug pricing expert analysis may be strengthened by having a perspective of prescriber volume. RxNorm is the data standard when prescribing via an electronic health record system. According to the U.S. National Library of Medicine, “RxNorm is two things: a normalized naming system for generic and branded drugs; and a tool for supporting semantic interoperation between drug terminologies and pharmacy knowledge base systems. The National Library of Medicine (NLM) produces RxNorm. Hospitals, pharmacies, and other organizations use computer systems to record and process drug information. Because these systems use many different sets of drug names, it can be difficult for one system to communicate with another. To address this challenge, RxNorm provides normalized names and unique identifiers for medicines and drugs. The goal of RxNorm is to allow computer systems to communicate drug-related information efficiently and unambiguously. RxNorm contains the names of prescription and many over-the-counter drugs available in the United States. RxNorm includes generic and branded:

- Clinical drugs – pharmaceutical products were given to (or taken by) a patient with therapeutic or diagnostic intent

- Drug packs – packs that contain multiple drugs, or drugs designed to be administered in a specified sequence”

Adoption of RxNorm grows significantly with the advent of the ARRA HITECH Act which provided stimulus funds for Meaningful Use of Electronic Health Records (E.H.R.s). EHRs use Computerized Provider Order Entry (CPOE) and electronic prescribing (ePrescribing) to electronically notify a pharmacy of a physician’s order to fulfill a prescription drug to a patient.

In addition to the standards noted, drug information for drug pricing expert analysis may include:

Name

Trade Names

Associated Diagnosis and Procedure Codes (ICD-10-CM/PCS, HCPCS, CPT)

Package pricing, average wholesale pricing (AWP), etc.

GPI Lineage/Hierarchy

Indications/Diseases

Labeler/Manufacturer

Active Ingredient

Common dosages

Dosage Form

Format (pill, liquid, gas, etc.)

Strength

Package types & descriptions

Route of Administration

Controlled Substance (DEA) Status

Efficacy

Maintenance drug status

Availability

Sources

Bioequivalences

Patient Information

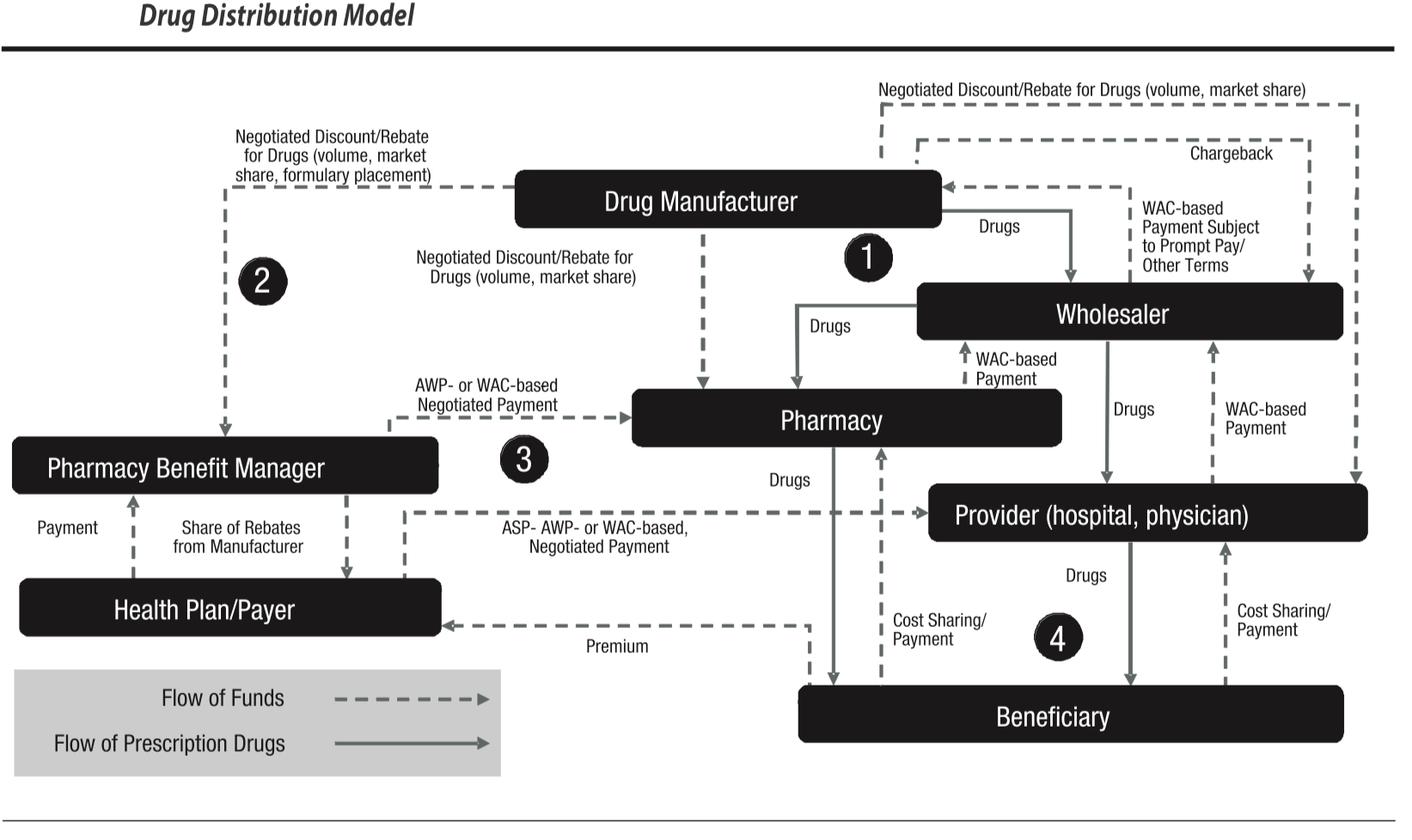

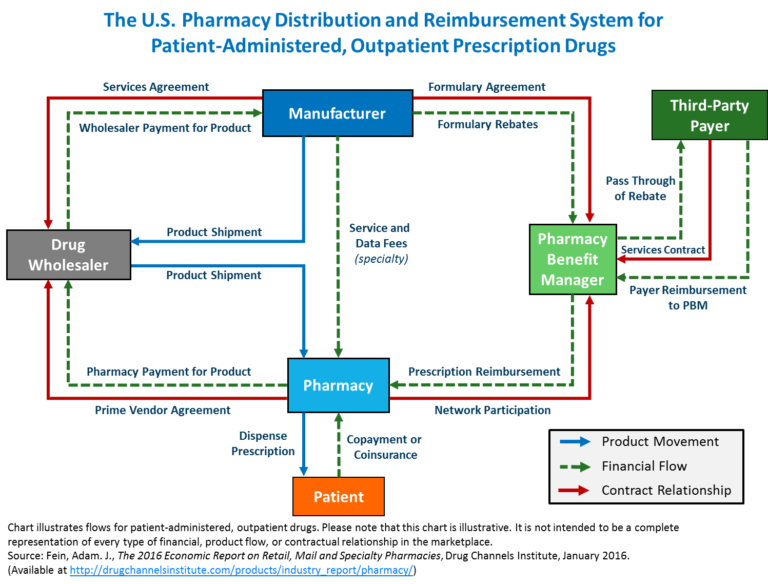

Drug pricing terminology used by Pharmacy Benefit Management Systems or PBMs may include:

· Weighted Average Cost (WAC), Average Wholesale Price (AWP), Average Sales Price (ASP)

· NDC price reporting

· Mark-Ups & Price Spreads

· Rebates

· “Brand” and “Generic”

· Formularies

· Pre-Authorization

· Clinical Rules & Protocols

· Mail-Order

· Plan Design

· Payor Account Crediting

Drugs Billed as Part of Inpatient vs. Outpatient Care

The cost of drugs may vary depending on whether the drug is prescribed and delivered in a hospital (or, a hospital or physician-owned ambulatory surgery center) or to an insured who received the medication at a pharmacy.

HCPCS Codes

HCPCS codes are used for the claim processing. Attributes such as time span are tracked and mapped by code.

CMS is now providing the HCPCS Level II code long descriptors in mixed case (instead of in ALL CAPS). Aside from the difference in case, there are no changes to the long descriptors. This change is being made under guidance from the CMS Office of Communications to comply with the Plain Writing Act of 2010, which requires that federal agencies use clear Government communication that the public can understand and use.

S codes – There are times a payer may deem the existing codes inadequate to describe an item or service and request an assignment for an S-Code. These are Non-Medicare codes created to identify an item or service when a code was not assigned and approved nationally like other codes sets such as HCPCS and CPT.

Coverage Determinations

Medicare Policies & Guidelines (NCDs, LCDs). Drugs are reimbursed by Medicare for medically necessary care. National Coverage Determinations (NCDs) and Local Coverage Determinations (LCDs) facilitated by Medicare Administrative Contractors may provide guidance on conditions and covered medications.

Private Payor Coverage Determinations

Diagnosis codes (conditions) and drugs by generic name or another type as well as HCPCs codes may be listed in private payor policies. These policies may detail several factors used in determining coverage. For example,

- members who are enrolled in a group Product with a specific tier Prescription Drug Benefit

- quantity limits

- require precertification through a Pharmacy Benefit Manager (PBM)

- require precertification through Medical Management

- standard exclusions (such as weight loss medications, fluorides, vitamins

Generally, medications are listed alphabetically with an explanation of how precertification is obtained and under which benefit it is covered.

While a medication by itself may not require precertification, specific exceptions such as Home Care for the administration of medication may require precertification, or there may be an exception for the first few days of therapy.

Generally both Medicare and Private Payors map to HPCPCs codes.

Related Posts

Drug Pricing Legislation Efficient Markets

Expert witness for Medical Billing and Coding

Expert Witness

Portions of this post cite:

http://www.propharmaconsultants.com/edu/intern/2015_01_DrugClassification.pdf